Tax Free Bicycles / Commuter was set up by former Tour de France cyclist Laurence Roche to help both Employers & Employees to take advantage of the initiative and to best advise on how to operate it within the organisation. There is a limit of €1,000 on which an employee or director can receive tax relief. Additionally, the exemption from income tax in respect of the benefit-in-kind can only be availed of once in any five-year period.

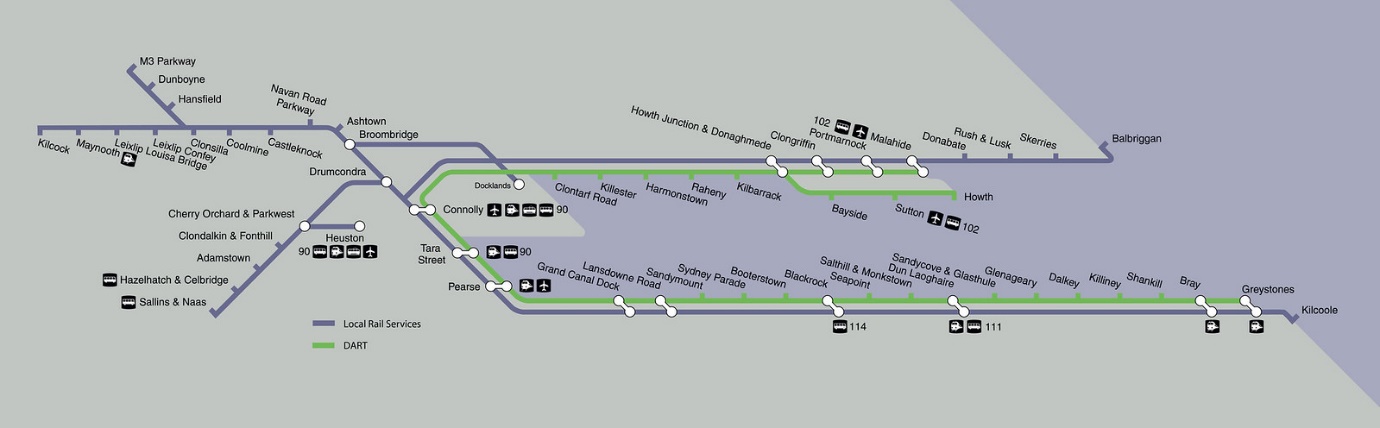

Avoid the hassle of commuting by car and travel in comfort by rail. Irish Rail have a fantastic network to help get you to work as stress free as possible. Employees and directors can receive Annual, Monthly commuter tickets Tax and PRSI free as part of their salary package. Employers will also receive tax relief for the purchase of tickets for their employees

In addition to the DART service, Irish Rail operate a vast commuter service nationwide where you can commute to work in comfort.

Luas offer a great service in Dublin with tickets available on their own or in combination with Dublin Bus and or Irish Rail.

Take advantage of all the pre-tax benefits provided by your employer and save!

You can SAVE UP TO 49.5% when you order commuter Bus, Rail, Luas, Dart, Commercial Bus Operator tickets or cycle to work vouchers through your employer and TaxFreeCommuter. The amount will be deducted from you’re salary where you will receive the tax relief. See your employer to determine which schemes are offered.

Taking care of your people is important!

Tax Free Commuter offer employers a FREE service to greatly reduce the time needed to administer the Taxsaver and Cycle to work schemes. Through our portal you can order commuter tickets or Bikes and accesseries for the cycle to work scheme, at NO COST. Employers will also save 10.75% PRSI on the value of the commuter ticket or bike. With only one contact for Taxsaver and Cycle to work why not contact us today.

Here is just a small selection of our most often asked questions.

Once you have activated your account, simply login and select either bikes or the transport mode you require. You can then submit your order for the bike or ticket with your chosen supplier.

No, all TaxSaver tickets and Bikes must be purchased by the Employer on behalf of the employee as per Revenue guidelines. Check out our 'How it works' page for full information.

No. Under current legislation, you can only avail of the tax relief if your employer purchases the bike on your behalf using our vouchers as payment. Our 'How it works' page explains in more detail.

No. However, the bicycle must be used mainly for qualifying journeys (i.e. travelling to and from work or between places of work).